QuickBooks can help with the mechanics, but there is a lot you need to learn before you can start charging and paying them. I won’t tell you that there are “seamless” solutions out there but certain apps and automation services can help.When all the payments are made with the help of other transaction sorts, like Make General Journal Entries, Pay Bills or Write Checks, in that case, the Pay.Setting up Sales Taxes in QuickBooks, Part 1 Next to payroll, state sales taxes represent probably the most complex element of your accounting tasks. Business owners must act as the unpaid agents of the government in deciding what and who gets taxed, collecting the tolls, and remitting to one of many state governments, while hoping that all is correct to avoid penalties and intrusive audits. If you file your return or pay tax late, a late penalty of 10 of the amount of tax owed, but not less than 50, may be charged.Sales taxes are a pain for most businesses. Taxpayers who paid 20,000 or more in sales and use tax during the most recent state fiscal year (July 1 - June 30) are required to file and pay electronically during the next calendar year.

Sales Tax Compliance can be ComplicatedLong ago everyone agreed that sales taxes should be simple: businesses would collect a small tax on certain sales and local governments would not interfere much. A wrong guess can leave your operation liable for uncollected sales taxes, which often generates losses on affected transactions (yes, because local governments often make better margins on sales than the business). If exist check is duke and coded to the Sales Tax Liability.QB (herein, both QuickBooks desktop and QB Online products) have native features for dealing with sales taxes, but leave much of the decision making on each transaction up to the business.

Quickbooks Pay Sales Tax Liability Software Decides Which

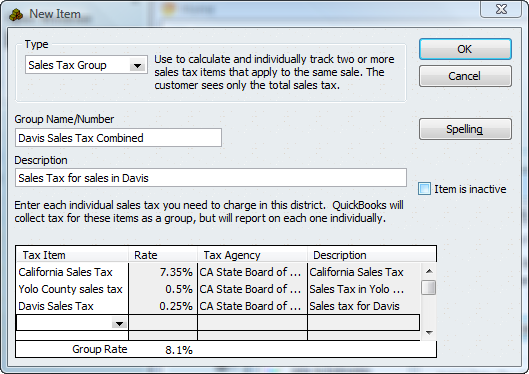

The software decides which addresses are relevant to particular products and localities, determine the right tax rates and automatically mark-up your invoice.Businesses are increasingly required comply, file and pay sales taxes in multiple jurisdictions if they meet the local definition of “nexis.” Look into this to make sure that you are not incurring this liability and failing to pay. Which can be done but takes time this is where sales tax apps come in – these services integrate with QuickBooks and generally manage all of these sales tax compliance issues – allowing the business owner to focus on more productive areas. It just depends.Then there is the question of where to apply the rates: what if a business located in the city north of you buys a pallet of materials delivered to a job site south of you? QB leaves the decisions on this to the user. Sometimes nexis means a brick-and-mortar retail location sometimes it means someone representing your company who visited a locality for the most trivial reason and now you are liable for sales taxes. You may want to ask an accountant or colleague about this (or your QB sales tax app provider), and read-up on the local situation yourself, because the local definitions of nexis vary widely. Increasingly, and like payroll taxes, sales-taxes cannot be managed by mere humans and are best handled by some great apps and web-services specializing in this area (some listed at the end of this article).The first issue in dealing with sales taxes is “Nexus.” If your business has a nexis (defined loosely as a significant presence where you may be using local government resources) in a taxing jurisdiction, you are likely required to deal with their sales tax codes, tax rules and more.

Getting and electronic relationship with your state (and through this, localities) can be accomplished by setting up and logging into your sales tax account, which normally lists histories, payments, due dates, balances etc. But this does have its advantages for small-businesses. Integrated QB Apps can do this faster and more accurately than mere people.An increasing number of states require e-filing of tax returns, mainly to reduce processing and compliance expenses (on their end, not yours). This is best accomplished by figuring customer location using latitude and longitude coordinates.

This makes these calcs much easier and reliable. QB apps and QB Web Services generally reduce this to a one-time effort in mapping your product lines to UPC codes, which are then be compared against different nexis to determine the sales tax. A product taxable in one area might not be in another.

For each situation, review if the customers’ tax-exempt status is current and agrees with the terms of their claimed exemption.New taxpayers and larger businesses may be required to pay a big chunk of estimated taxes at the beginning of each period. Few customers like being told that they must pay sales taxes, but make sure that all is correct here before the product ships. Going back to customers and asking for repayment of their disallowed exemption is not likely. An audit may disallow many of these exemptions and result in large increases in sales taxes due, penalties and interest. Sales tax exemptions make everyone happy until there is an audit. For example, in southern California there is an exemption for media production equipment.

0 kommentar(er)

0 kommentar(er)